When it comes to buying a home, the property cost is far from the only factor that affects what you will be paying from month to month. Different loan types offer different terms in the short and long term, and some come with additional costs that you will need to factor into your budgeting. One important matter concerns your choice to receive an FHA or conventional loan. Both have their advantages, but it can be hard for you to assess which is right for you as an individual buyer. How can you make sure you secure the right funding and have the right terms for the life of your mortgage? FHL Texas can work closely with you to find the backing that makes the most sense for you over time.

When it comes to buying a home, the property cost is far from the only factor that affects what you will be paying from month to month. Different loan types offer different terms in the short and long term, and some come with additional costs that you will need to factor into your budgeting. One important matter concerns your choice to receive an FHA or conventional loan. Both have their advantages, but it can be hard for you to assess which is right for you as an individual buyer. How can you make sure you secure the right funding and have the right terms for the life of your mortgage? FHL Texas can work closely with you to find the backing that makes the most sense for you over time.

What Makes An FHA Loan Different From A Conventional Loan?

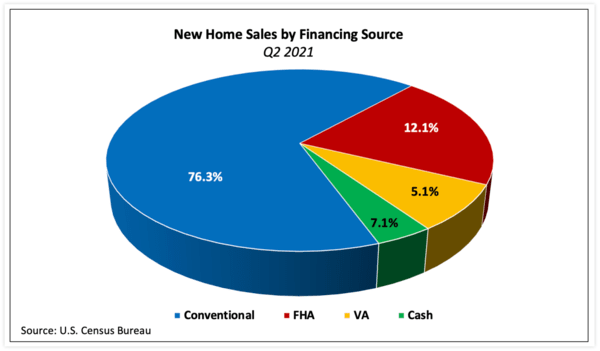

Government-backed FHA loans are insured by the Federal Housing Administration. Conventional loans do not have government support, and often have backing from Fannie Mae or Freddie Mac. Each option has benefits for borrowers that should be taken into account. For first-time buyers and those with lower credit scores, FHA loans offer welcome advantages. However, not all properties receive approval for these mortgages, and you may need a loan that provides a higher overall amount. You will also need a conventional loan if you want to buy a second home or investment property. Another matter to consider is your mortgage insurance premium (MIP), which will add to your monthly payments.

Your Options For Managing Your Down Payment

Both of these mortgage options can provide buyers with the option to make modest down payments. With a credit score of 580 or higher, you can receive your FHA loan with a 3.5% down payment; a buyer with a score of at least 620 can secure a conventional loan with just a 3% down payment. Because the down payment minimum has fallen to 3% on Fannie Mae- and Freddie Mac-backed loans, conventional mortgages have become more appealing to prospective buyers who like the idea of a low down payment.

While the right terms on your initial down payment can be important, remember that what you spend on this initial cost affects the overall size of your loan. With an LTV of 80% or better, you can drop the need for mortgage insurance payments on your conventional loan. However, when you take out an FHA loan, the premium can be required for the lifetime of your mortgage.

How FHA Loans Help First Time Buyers And Those With Lower Credit Scores

While you should consider how different loan terms will impact you as an individual, we should note that FHA loans are often helpful to first time buyers and those who have lower credit scores. Because a buyer can shrink their down payment even with a more modest 580 credit score, FHA loan terms can sometimes be needed to make a purchase possible.

First time buyers often find FHA loans ideal because they help you work around certain hurdles in lending. In addition to having a lower FICO score, people making their initial property purchases tend to have less money to put forward on a down payment because they are not leaving behind a property that they are selling. Having a government-backed loan to help you work around these issues, along with a higher LTV, can make that important first purchase easier to arrange!

How Your MIP Affects The Monthly Cost Of Your FHA Loan

It can be difficult to assess just how much you are committing to on a monthly basis when you look into loan terms. After all, your costs are influenced by more than just your interest and premium; for many buyers, including all who rely on FHA loans, insurance payments will also be required. As of 2013, FHA loans require MIPs that will be paid for the duration of the mortgage. In effect, your monthly costs and the lifetime cost of the mortgage will be higher, and you will need to account for that in your budgeting. You will also need to be prepared to pay an annual premium. This can make a conventional loan the preferable option for those who qualify.

With a conventional loan with an 80% or better LTV, the premium can be avoided entirely. Many people who secure loans that are backed by Fannie Mae or Freddie Mac can receive discounted insurance costs, and some select terms can even provide a 3% down payment and still do without insurance!

Conventional Loans Can Provide More Flexibility

Conventional loans can provide advantages to those who want to purchase a higher value home, as well as for those who want more flexibility in their terms. Loans vary in more than just size. Your rate over time, the length of the mortgage, and your initial receipt of funds can take different forms based on what you agree to when you secure a conventional mortgage. We can help buyers who rely on Fannie Mae or Freddie Mac to make purchases settle on a fixed or adjustable rate mortgage (ARM), explore the advantages to interest-only loans, and settle on how long they will continue to pay to finalize their home purchase. You will also have to take the conventional route if you want a true jumbo loan.

In contrast, FHA loans provide less freedom in selecting how you intend to receive and pay down your mortgage. You can use them for both purchase and refinance loans, but you can have less to choose from when it comes to your terms. 30-year and 15-year fixed loans are often provided, though you may be able to secure a 5/1 ARM.

Another concern is that the property you are considering may not be approved for an FHA loan. This is the case for many condominiums as well as some conventional home properties. FHA loans are not available for investment properties or second homes.

How A Property’s Value And Condition Affects Loan Preferences

Both higher value homes and properties that require more work can make conventional mortgages necessary. For the former, the issue is that FHA loans tend to have relatively low ceilings that limit what borrowers can receive. Properties unable to meet certain property standards can fail to qualify for these terms. Worries about receiving that approval may make sellers wary of buyers who are considering FHA loans.

Can I Move From An FHA To A Conventional Loan?

While a government-backed mortgage can be right for you today, it may be less beneficial in the long term. The good news is that you can make the move from an FHA to a conventional loan when you refinance. Many buyers will take advantage of both a rising credit score from their regular mortgage payments and the rising equity of their home to make the move to a loan that has better terms and no longer requires insurance premium payments.

FHL Texas Can Help You Secure Your Home Loan!

Even if you have already been through the home buying process, the right professional support can prove valuable. In addition to finding the right property, you need to determine what loan truly suits your needs as a buyer. With our experience in lending and real estate, FHL Texas can offer clarity and guidance. Whether you are trying to decide between a conventional or FHA loan, want to secure the right payment terms, or need to negotiate a sale as well as a new purchase, we are here for you! To learn more about the support we can provide, reach out to FHL Texas at 1-800-990-LEND (5363).